Finance Runs Away From New York

“Who is like Tyre, like her that has been brought to silence in the midst of the sea? When your stores went forth from the open sea, you satisfied many peoples. With the abundance of your valuable things and your articles of exchange you made earth’s kings rich. Now you have been broken by the open sea, in the depths of the waters." Ezekiel 27:33-34

“Who is like Tyre, like her that has been brought to silence in the midst of the sea? When your stores went forth from the open sea, you satisfied many peoples. With the abundance of your valuable things and your articles of exchange you made earth’s kings rich. Now you have been broken by the open sea, in the depths of the waters." Ezekiel 27:33-34

Are the reasons given for this threat are the only ones ???

New York is facing a threat to its position as the world's leading financial centre, according to a report commissioned by Michael Bloomberg, the city's mayor, and New York Senator Chuck Schumer. If current trends continue, New York could lose up to 7 per cent of its market share, equivalent to 60,000 jobs, over the next five years. But much of that loss would be prevented if the US implemented legal and regulatory reforms, says the report by McKinsey, the consultancy. Mr Bloomberg and Mr Schumer commissioned the study amid increasing concern over New York's declining share of global capital markets activity.

Concern has focused on the rise in the number of foreign companies choosing to list their shares in London and Hong Kong rather than in New York. The report, published on Monday, says New York has also been losing out in areas such as derivatives, where Wall Street chief executives say they have been shifting business to London because of its more attractive legal and regulatory environment. Financial services employment in London rose 4.3 per cent to 318,000 in the three years to 2005, while it fell by 0.7 per cent to 328,000 in New York, the report says. Mr Schumer said the study showed that New York could lose its leadership "not just for IPOs but for all financial services, all too easily and all too soon". McKinsey based the report partly on interviews with 50 financial services chief executives. There was a consensus that New York had become less attractive than London over the past three years, and many expected the trend to continue. A senior member of Mr Bloomberg's staff said that while New York would lose some share because of maturing capital markets in Europe and Asia, the decline could be "substantially" stemmed if the report's "very realistic" recommendations were put into effect. These include clearer guidance on the Sarbanes-Oxley corporate governance rules, securities litigation reform, promoting the convergence of accounting standards, and easing visa restrictions on foreign professionals. John Thain, chief executive of the New York Stock Exchange, warned last year that the competitiveness of New York was being undermined by the litigious US climate and Sarbanes-Oxley. The fears prompted the formation of a panel of Wall Street executives and academics, with the backing of Hank Paulson, US Treasury secretary. In November, the group called for similar reforms. Chuck Prince, chief executive of Citigroup, recently forecast continued "diffusion away from New York". In the fourth quarter of last year, Citigroup's corporate and investment bank earned more in both Europe and Asia than in the US for the first time.

About my reference to Tyre:

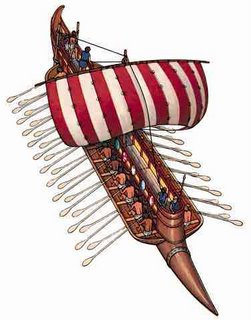

"The modern cities of Tyre and Sidon on the Lebanese coast were once the major launching points of the seafaring Phoenicians. They were to the ancient world what Venice, Shanghai, Liverpool and New York have been in later times: some of the greatest of the world's ports, and crucial conduits for trade and cultural exchange. From the harbours of the Phoenician cities, ships carried precious dyes and textiles, soda and glass throughout the Mediterranean and beyond." http://www.bioedonline.org/news/news.cfm?art=2253

UPDATE FROM DAVOS WORLD ECONOMIC FORUM EXECPTS:

How Bush Has Shot US Capital Markets In The Foot

By Jeremy Warner in Davos

Published: 26 January 2007

"Behind the scenes, on the other hand, the UK is winning a somewhat higher profile. Or more particularly, the growing success of the City as a financial centre, and the march it is stealing on New York, is a source of constant discussion among the sizeable contingent of financiers and investment bankers here."

"Even American companies, never mind the foreign ones Nasdaq would once routinely have attracted, are choosing to list in London because of the misery of Sarbanes Oxley, an onerous set of rules and regulations that America has imposed on its publicly listed companies. Yet these defeats are only the high-profile end of a much wider loss of competitiveness. Across the piste of the financial markets, New York is losing out to London. Few here will talk publicly about the phenomenon, yet off the record there is common agreement about the causes. The light touch, principles-based regulation pursued by the Financial Services Authority is plainly one reason. This is widely acknowledged as more conducive to the operation of the capital markets than the rules-driven approach of the Securities & Exchange Commission. Yet the bigger cause is that the fast-growing economies of the developing world, together with the old and new petrodollars of the Middle East and Russia, simply don't trust the US with their money. Never mind what else it has done, George Bush's foreign policy has succeeded in shooting American capital markets in the foot like nothing else. In the process, it has cemented London's position as the default centre of choice. Few stories here in Davos better illustrate the conference's theme of the shifting power equation. According to one participant here, US homeland security measures that require banks to monitor all transactions in dollars have encouraged a significant shift into euro-denominated assets in international markets."